After studying this chapter, you should be able to.

- Define an accounting systems and describe its implementation.

- List the three objectives of internal control, and define and give examples of the five elements of internal control.

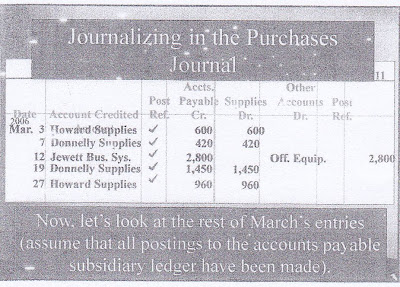

- Journalize and post transactions in a manual accounting system that uses subsidiary ledgers and special journals.

- Describe and give examples of additional subsidiary ledgers and modified special journals.

- Apply computerized accounting to the revenue and collection cycle.

- Describe the basic features of e-commerce.

Objectives of Internal Control

To provide reasonable assurance that:

- assets are safeguarded and used for business purposes.

- business information is accurate.

- employees comply with laws and regulations.

Elements of Internal Control

- Control environment

- Risk assessment

- Control procedures

- Monitoring

- Information and communication

Control Procedures

- Competent Personnel

- Rotating Duties

- Mandatory Vacations

- Separating Responsibilities for Related Operations

- Separating Operations, Custody of Assets, and Accounting

- Proofs and Security Measures

Otherwise, the following abuses are possible: Related Operations

- Orders may be placed on the basis of friendship with a supplier, rather than on price, quality, and other objective factors.

- The quantity and quality of supplies received may not be verified, this causing payment for supplies not received or poor-quality supplies.

- Supplies may be stolen by the employee.

- The validityand accuracy of invoices may be verified carelessly.

Clues to Potential Problems

Warning signs with regard to people:

- Abrupt changes in lifestyle.

- Close social relationships with suppliers.

- Refusing to take a vacations.

- Frequent borrowing from other employees.

- Excessive use of alcohol or drugs.

Warning signs from the accounting system:

- Missing documents or gaps in transaction numbers.

- An unusual increase in customer refunds.

- Differences between daily cash receipts and bank deposits.

- Sudden increase in slow payments.

- Backlog in recording transactions.

No comments:

Post a Comment